OH Fidelity IRA Inherited IRA App free printable template

Show details

FIDELITY IRA AND INHERITED IRA APPLICATION INSTRUCTIONS

Complete this application if you are a beneficiary of an IRA (including Traditional, Rollover, Roth, SEP, or SIMPLE), an Inherited IRA, or employer-sponsored

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign inherited application instructions pdffiller form

Edit your inherited ira application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity inherited ira application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing inherited application instructions fillable online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit spouses application fidelity template form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out spouses application fidelity get form

How to fill out OH Fidelity IRA & Inherited IRA App

01

Gather necessary personal information, such as Social Security number, address, and employment details.

02

Get the required identification documents, like a driver's license or passport.

03

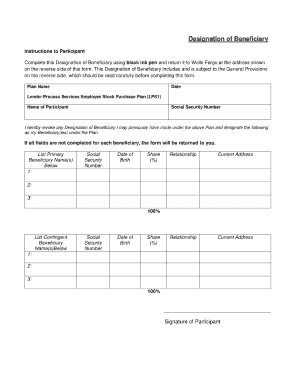

Determine your beneficiary information for the Inherited IRA, including their full name, date of birth, and Social Security number.

04

Complete the specific sections for the OH Fidelity IRA and Inherited IRA in the application, ensuring you follow the instructions for each section carefully.

05

Sign and date the application once all sections are completed.

06

Submit the application either online or via mail, as indicated in the instructions.

Who needs OH Fidelity IRA & Inherited IRA App?

01

Individuals looking to save for retirement through a Fidelity IRA.

02

Beneficiaries who have inherited assets and need to establish an Inherited IRA.

03

People seeking tax-advantaged growth on their investments for future financial security.

Fill

fidelity inherited ira form

: Try Risk Free

People Also Ask about spouses application fidelity search

What is the difference between state and federal state?

Overview. There are different types of laws. Federal laws apply to everyone in the United States. State and local laws apply to people who live or work in a particular state, commonwealth, territory, county, city, municipality, town, township or village.

What does it mean if a government is federal?

Federalism is a system of government in which the same territory is controlled by two levels of government. Generally, an overarching national government is responsible for broader governance of larger territorial areas, while the smaller subdivisions, states, and cities govern the issues of local concern.

What does federal mean in simple terms?

federal. / (ˈfɛdərəl) / adjective. of or relating to a form of government or a country in which power is divided between one central and several regional governments. of or relating to a treaty between provinces, states, etc, that establishes a political unit in which power is so divided.

What does it mean if something is federal?

: of or relating to the central government of a federation as distinguished from the governments of the constituent territorial units (as states) especially : of or relating to the laws made and enforced by the federal government. a federal crime.

What's the federal government?

The Federal Government is composed of three distinct branches: legislative, executive, and judicial, whose powers are vested by the U.S. Constitution in the Congress, the President, and the Federal courts, respectively.

What does federal mean in government simple?

A federal government is a system of dividing up power between a central national government and local state governments that are connected to one another by the national government. Some areas of public life are under the control of the national government, and some areas are under control of the local governments.

What is federal vs state?

Federal law establishes the rights and rules for all the citizens of the United States, while state law adds to those rights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

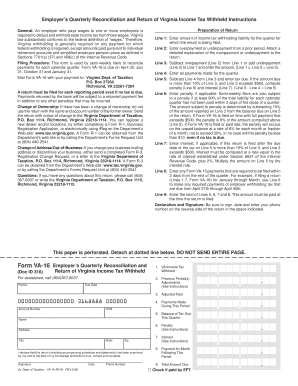

How do I execute fidelity ira application online?

Completing and signing fidelity rollover form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I fill out fidelity roth ira paper application on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your fidelity rollover ira form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete letter of instruction template fidelity on an Android device?

Use the pdfFiller mobile app to complete your open inherited ira fidelity on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

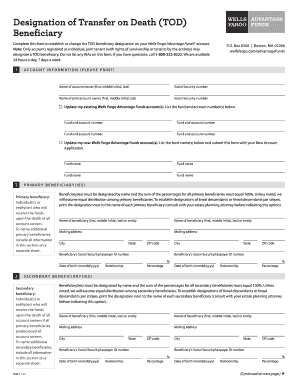

What is OH Fidelity IRA & Inherited IRA App?

The OH Fidelity IRA & Inherited IRA App is a financial application designed to help individuals manage and apply for Fidelity Individual Retirement Accounts (IRAs) and inherited IRAs, providing users with tools and resources to optimize their retirement savings.

Who is required to file OH Fidelity IRA & Inherited IRA App?

Individuals looking to open a new Fidelity IRA or to manage an inherited IRA are required to file the OH Fidelity IRA & Inherited IRA App, including beneficiaries of IRAs who need to claim their inherited accounts.

How to fill out OH Fidelity IRA & Inherited IRA App?

To fill out the OH Fidelity IRA & Inherited IRA App, applicants must carefully complete the provided forms, ensuring accurate personal and financial information is provided, and follow the specific instructions outlined in the application.

What is the purpose of OH Fidelity IRA & Inherited IRA App?

The purpose of the OH Fidelity IRA & Inherited IRA App is to streamline the process of applying for and managing Individual Retirement Accounts, including providing a clear pathway for beneficiaries to manage inherited accounts effectively.

What information must be reported on OH Fidelity IRA & Inherited IRA App?

The information that must be reported on OH Fidelity IRA & Inherited IRA App includes personal identification details, financial information, account preferences, and, if applicable, details of the inherited IRA, including the original account holder's information.

Fill out your OH Fidelity IRA Inherited IRA App online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Ira Transfer Process is not the form you're looking for?Search for another form here.

Keywords relevant to wells fargo site pdffiller com site blog pdffiller com

Related to fidelity ira transfer form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.